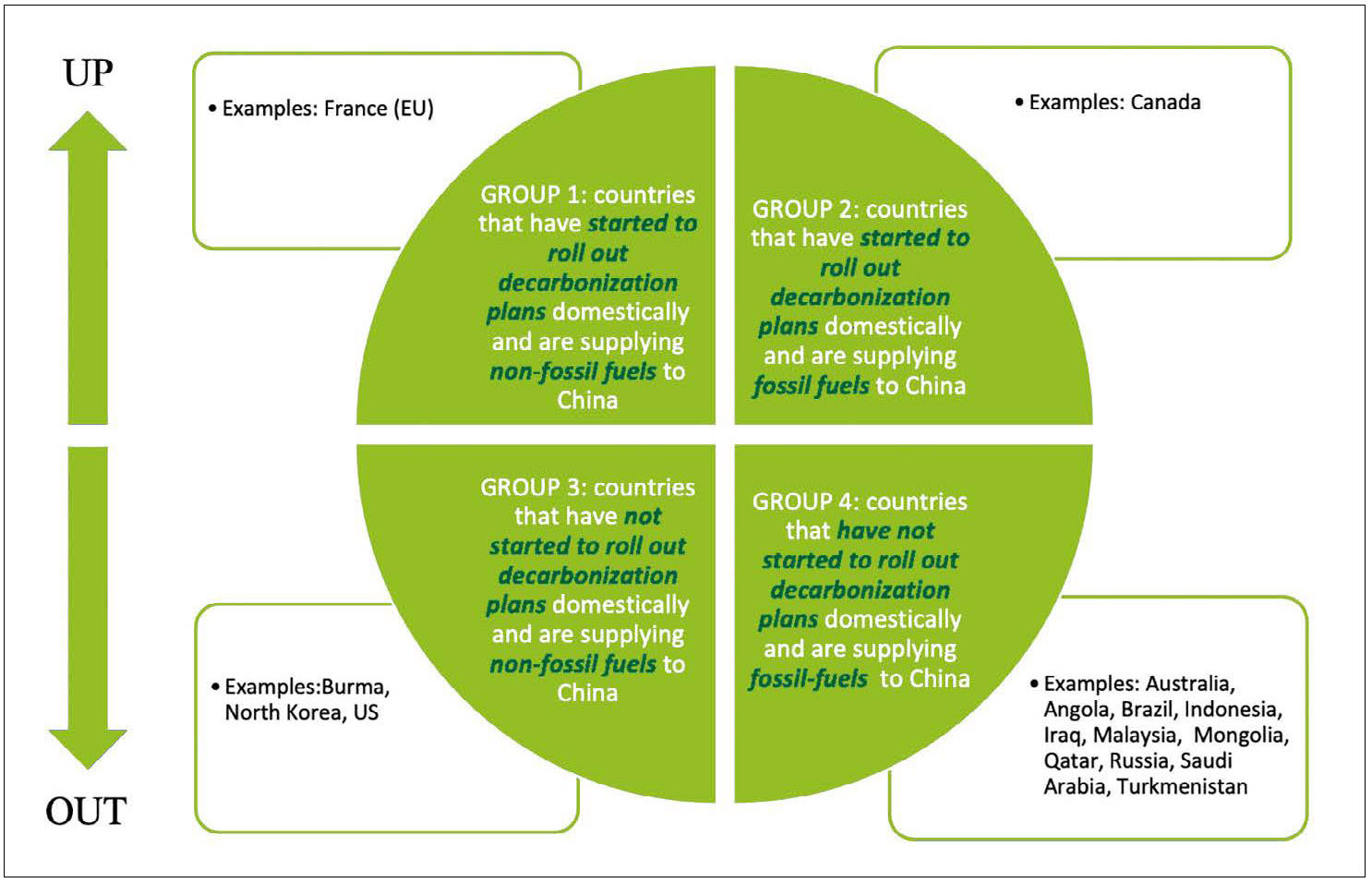

How are global trade and investments in energy likely to be impacted by China’s pledge to reach carbon dioxide neutrality before 2060? How will countries need to respond to stay ahead of the game, or simply not to miss trade and investment opportunities with a net zero carbon China? This paper argues that the impacts of China’s decarbonization in energy trade and investments will be felt differently across the globe depending on countries’ environmental performance, the profile of their energy exports to China, and the availability of decarbonization plans domestically. Countries that have already started to roll out their decarbonization and are supplying non-fossil fuels to China are more likely to level up their bilateral engagement. Countries that have not yet started to roll out their decarbonization plans and are supplying fossil fuels to China are more likely to restrain, if not phase out, their economic relations with the Asian giant. This paper concludes that China’s proposal to achieve net zero emissions by 2060 could be the turning point for fossil fuel markets and the global energy transition, creating a future of mutual adaptation for China and its sources of energy supply.

At the 75th United Nations General Assembly in September 2020, Xi Jinping pledged to further align China with the global target of limiting temperature rise to 1.5°C by reaching carbon dioxide (CO2) neutrality before 2060. The commitment was a surprise to the international community considering China has long argued that, as a developing economy, it should not have to share the same burden of curbing emissions as developed nations, whose pollution went unchecked for decades.

For China, the pledge was a calculated move not only to project positive leadership abroad, but also to strengthen the economy, environmental protection, and governance at home. According to the Boston Consulting Group,[1] a plan to achieve the 1.5°C global target could create new jobs, ramp up investments in green technology, and contribute 2% to 3% to China’s GDP between now and 2050. It could also help mitigate concerns over energy security and public health, increasingly perceived as threats to the Chinese Communist Party’s standing.

Two months later, Xi announced upgraded climate targets for 2030, including to peak CO2 emissions within the next decade, lower CO2 emissions per unit of GDP by 60% to 65% from the 2005 level, and increase the share of non- fossil fuels in energy consumption to around 20%.[2] Yet, the country still lacks a roadmap to fully decarbonize its economy. The granting of permits for the construction of coal-fired power plants as part of a post-pandemic stimulus further adds skepticism on China’s prospect of carbon neutrality.[3]

The recently approved 14th five-year plan (2021-2026) does not contain a road map toward China’s decarbonization either, though this does not necessarily mean the country will refrain from developing one as the plan unfolds. In fact, The Fifth Plenary Session of the 19th Central Committee of the Communist Party of China, the Central Economic Work Conference and the 2021 “Two Sessions” emphasized the need to “work diligently towards carbon peaking and carbon neutrality” and to continue balancing China’s carbon-related goals with the country’s vision for economic growth up to 2035.

Despite the uncertainty on whether and how China will meet this goal, what is clear is that the country will need to mount a concerted effort throughout its economy to immediately adopt a 1.5°C pathway to carbon reduction of 75% to 85% by 2050. This is because though China’s CO2 emissions have been relatively stable since 2013 and are projected to plateau by 2025, under business-as-usual the country would only be able to reduce carbon emissions by a little more than 10% by 2050.[4]

Studies point that energy consumption, transition, and efficiency must be at the centre of China’s roadmap to decarbonization.[5] With regard to consumption, research by Tsinghua University and the Massachusetts Institute of Technology indicates that in 2060 fossil fuels would account for 16% of the energy consumed in China down from approximately 78% in 2019.[6] Regarding transition, nuclear power would need to increase sixfold, and hydroelectricity would need to double to replace coal. Technologies that can capture CO2 released from burning fossil fuels or biomass and store it underground would be needed to compensate not only fossil fuel residual consumption but also the CO2 already in the atmosphere.

As a global manufacturing and innovation powerhouse, China’s decarbonization could enable other countries to realize their own plan to net zero CO2 emissions and create new, dynamic possibilities for trade and investments. For example, since 2018 China has become a net importer of rare earth elements – a cluster of minerals used in green technologies such as wind turbines, rechargeable batteries, and electric vehicles. As other countries move up the ladder in preliminary processing of rare earth elements, China is likely to follow with increased investments in their processing industry in addition to imports, thus creating a positive spiral towards decarbonization.[7] The lack of a robust roadmap by some of these countries to net zero CO2 emissions, however, could restrain economic relations with China. How are global trade and investments in energy likely to be impacted by China’s decarbonization? How will countries need to respond to stay ahead of the game, or simply not to miss trade and investment opportunities with China?

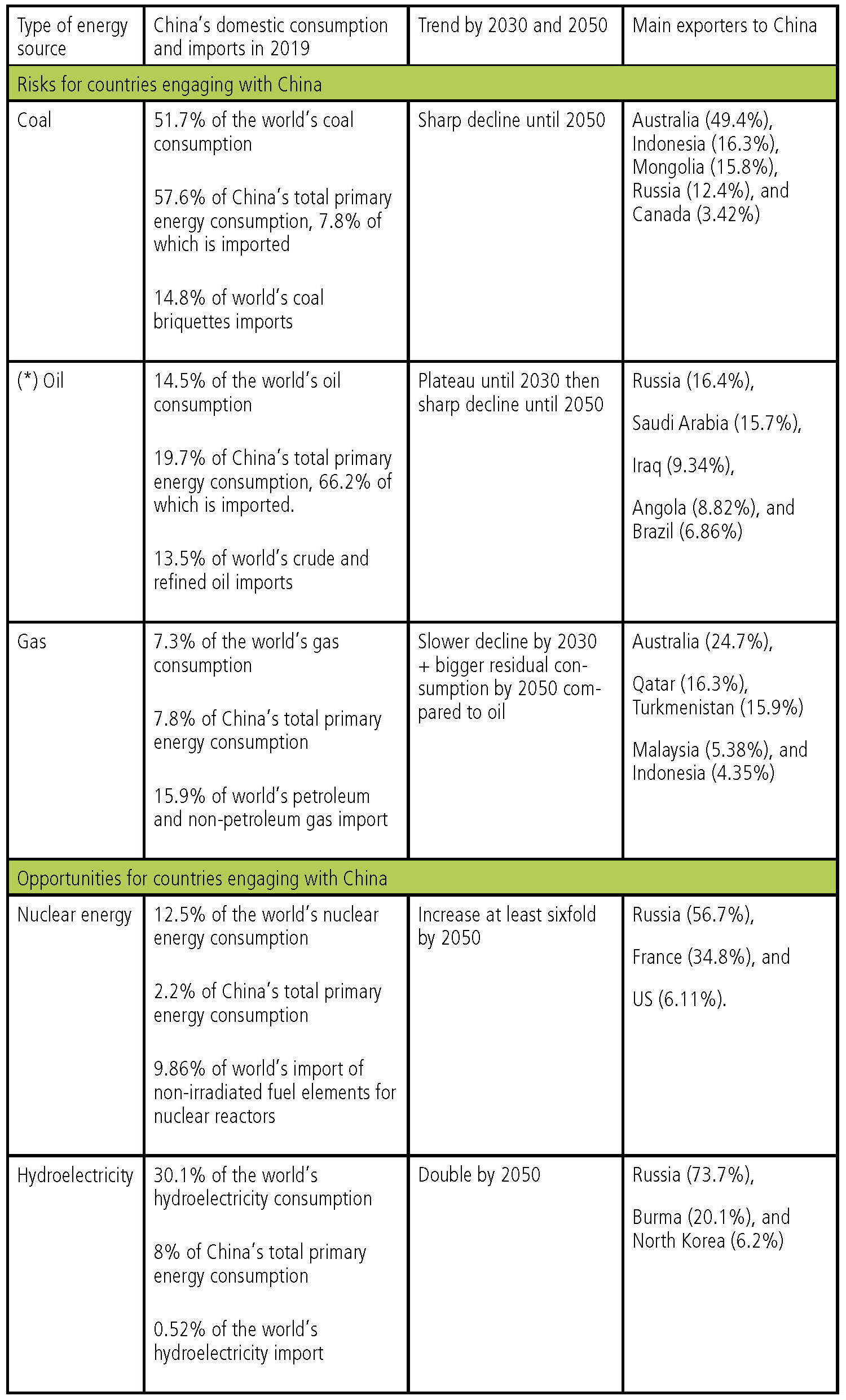

First, a sharp contraction in China’s demand for coal within the next decade could severely impact coal markets worldwide. In 2019, 51.7% of the world’s coal consumption originated in China. Coal also accounted for 57.6% (81.67 exajoules) of China’s total primary energy consumption, from which 7.8% (6.4 exajoules) was imported.[8] In the same year, China was among the world’s top importers of coal briquettes with 14,8%, only behind India (19.5%) and Japan (17.2%) according to data from the Observatory of Economic Complexity (OEC).[9] China imported a total of USD19 billion from Australia (49.4%), Indonesia (16.3%), Mongolia (15.8%), Russia (12.4%), and Canada (3.42%).

Oil, gas, and other fossil-fuel markets could suffer a similar impact. In 2019, 14.5% of the world’s oil consumption originated in China. Oil also accounted for 19.7% (27.91 exajoules) of China’s total primary energy consumption, from which 66.2% was imported.[10] In the same year, China was the world’s top importer of crude and refined oil with a total of USD226 billion (13.5%) of the world’s imports from countries like Russia (16.4%), Saudi Arabia (15.7%), Iraq (9.34%), Angola (8.82%), and Brazil (6.86%), according to OEC data. Yet, oil consumption in China is likely to plateau in the next decade before it begins to drop sharply.[11]

Gas consumed in China, for its turn, accounted for 7.3% of the world’s gas consumption and 7.8% of China’s total primary energy consumption in 2019.[12] In the same year, China was the world’s top importer of petroleum and non-petroleum gas with a total of USD47.8 billion (15.9%) of the world’s imports from Australia (24.7%), Qatar (16.3%), Turkmenistan (15.9%), Malaysia (5.38%), and Indonesia (4.35%) according to OEC data. Unlike oil consumption, however, gas has yet to hit its peak by 2030 before it begins to decline. Nevertheless, projections indicate that gas will still have a greater role in China’s energy mix than oil by 2050.[13]

Second, the acceleration of China’s clean energy transition, in part to replace coal-fired and other fossil-fueled power generation, would have a positive impact on the global nuclear, hydroelectricity, and renewables markets. In 2019, non-fossil fuels consumed in China accounted for 23% of the world’s non-fossil fuels consumption and 14.9% of China’s total primary energy consumption. In the same year, 12.5% of the world’s nuclear energy consumption originated in China. Nuclear energy accounted for 2.2% of China’s energy mix and may increase sixfold by 2050.[14] This will potentially lead China to realign its different sources of domestic energy supply. Also, in 2019, China was the world’s third largest importer of non-irradiated fuel elements for nuclear reactors with 9.86% after Ukraine (14.9 %) and France (13.9%). The country imported a total of USD266 million from Russia (56.7%), France (34.8%), and the United States (6.11%), according to OEC data.

In 2019, hydroelectricity consumed in China accounted for 30.1% of the world’s hydroelectricity consumption and 8% of China’s total energy mix, with the possibility to double by 2050.[15] Hydroelectric energy plays a much less important role in mainland China’s import mix, with only 0.52% of the total world’s import compared to Hong Kong (2.36%) and Macau (1.28%). A total of USD184 million of China’s mainland electrical energy was imported from Russia (73.7%), Burma (20.1%), and North Korea (6.2%) whereby 100% of Hong Kong and Macau’s imports came from China mainland, according to OEC data. The patterns in China’s energy demand are summarized in Figure 1.

Figure 1: Patterns in China’s energy demand. Source: author’s own elaboration based on He, 2020; BP, 2020; and https://oec.world/en (*) Largest crude oil suppliers to China in 2019: Saudi Arabia (17.4%), Russia (16.5%), Iraq (10.3%), Angola (9.79%) and Brazil (7.6%). Largest refined oil suppliers to China in 2019: South Korea (29.1%), Russia (14.9%), Singapore (12.4%), and India (8.42%) (OEC, n.d.)

Third, in order to compensate for fossil fuel residual consumption and CO2 already in the atmosphere, China is likely to pair the transition to a cleaner energy matrix with Carbon Capture and Storage (CCS) and new forest growth. This move should open opportunities for megadiverse countries like Brazil, Indonesia, and the Philippines in areas like the purchase of carbon credits and investments in reforestation.

These impacts are likely to create four distinct patterns of interaction with China based on the profile of exports to China and countries’ readiness to roll out decarbonization plans domestically. The latter is measured by the existence of a decarbonization plan, supplemented by countries’ environmental performance according to Yale University 2020 Environmental Performance Index (EPI) (Figure 2).

Figure 2: Four patterns of interaction with a carbon-neutral China. Source: author’s own elaboration.

The first pattern of interaction with China comprises the countries that have started to roll out decarbonization plans domestically and are suppliers of raw materials needed for the transformation of China’s energy matrix. These countries also tend to feature high in the EPI and are more likely to reap the benefits of a net zero carbon China and level up their engagement with the country. For example, China is already a leader in battery cells and has been cooperating with the European Union in climate-related areas like clean energy, decarbonization technology, and carbon trading.

The second pattern of interaction with China comprises the countries that have started to roll out decarbonization plans domestically and are supplying fossil fuels to China. China’s energy transition will require new supply chains with producers of raw materials like copper, lithium, and cobalt which could help accelerate the transition to a new pattern of trade in these countries. In addition, the fact that these countries have already started the transition at home and feature high in the EPI suggests that a review of their export list could be a matter of time. Canada is an example of a country that features in this second group.

The third group of countries includes those that have not started to roll out decarbonization plans domestically and are supplying non-fossil fuels to China. The fact that these countries tend to have low environmental performance, however, suggests they may have their economic relations with China restricted in the long term. Examples include Burma, North Korea, and the US. Considering US relatively high performance in the EPI and Biden’s commitment to fighting climate change, the US could potentially move up to the first group.

The fourth group of countries includes those that have not started to roll out decarbonization plans domestically and are suppliers of raw materials no longer needed (at least not in the same quantities) to China. The fact that these countries tend to have low environmental performance indicates that their exports to and investments from China are likely to decline or even phase out in the long term. Examples include Australia, Angola, Brazil, Indonesia, Iraq, Malaysia, Mongolia, Qatar, Russia, Saudi Arabia, and Turkmenistan.

Russia could possibly migrate to the third group given its potential to increase nuclear and hydroelectricity exports to China from now until 2050 and its relatively strong performance in the EPI. For megadiverse countries like Australia, Brazil, Indonesia, and Malaysia, weak institutional and regulatory frameworks for investments in reforestation and the purchase of carbon credits could prevent these countries from upgrading to group three. A possible solution would be to cooperate with China, the EU and other countries, international organizations, and multilateral development banks with expertise in these fields.

China’s proposal to achieve net zero emissions by 2060 could be the turning point for fossil fuel markets and the global energy transition. The impacts on global trade and investments in energy however will be felt differently depending on the profile of countries’ exports to China and their readiness to roll out decarbonization plans domestically. These impacts could include the creation of new, dynamic possibilities for trade and investments as well as the realignment of China’s own different sources of domestic energy supply. Cooperation with China, governments, international organizations, and multilateral development banks could further help countries reap the benefits of a net zero carbon China and level up their engagement with the country, in addition to facilitating mutual adaptation for China and its sources of energy supply.

References

[1] Chen, B., Fæste, L., Jacobsen, R., Teck Kong, M., Lu, D., and Palme, T. (2020) “How China Can Achieve Carbon Neutrality by 2060”, Boston Consulting Group, 14 December, available online

[2] World Resources Institute (2020) “China Commits to Stronger Climate Targets at Climate Ambition Summit”, 12 December, available online

[3] Yi, S. (2020) “Is China’s post-pan- demic recovery off the green track?”, China Dialogue, 18th December, available online

[4] He, J. (2020) “Presentation at the Launch of the Outcome of the Resear- ch on China’s Long-Term Low-Carbon Development Strategy and Pathway”, Institute of Climate Change and Sustainable Development, Tsinghua University, 12 October, available online at: https://mp.weixin. qq.com/s/S_8aj- dq963YL7X3sRJSWGg

[5] Mallapaty, S. (2020) “How China could be carbon neutral by mid-century”, Nature, 19 October, available online

[6] British Petroleum (2020) Statistical Review of World Energy, 69th Edition, available online

[7] Liu, H. (2017) “As China adjust for ‘true cost’ of rare earths, what does it mean for decarbonization?”, Wilson Centre New Security Beat – the blog of the Environmental Change and Security Program, 21 March, available online

[8] British Petroleum (2020) Statistical Review of World Energy

[9] The Observatory of Economic Com- plexity platform for international trade data, available online

[10] British Petroleum (2020) Statistical Review of World Energy

[11] He, J. (2020) “China’s Long- Term Low-Carbon Development Strategy and Pathway”

[12] British Petroleum (2020) Statistical Review of World Energy

[13] He, J. (2020) “China’s Long- Term Low-Carbon Development Strategy and Pathway”

[14] Ibid., British Petroleum (2020) Statistical Review of World Energy

[15] Ibid.

“The SIPRI Yearbook is a compendium of cutting-edge information and analysis on developments in armaments, disarmament and international security. The 56th edition was released... Read More

In the past seven years, Armenia has gone through a roller-coaster of changes, crises, challenges, and upheavals. In 2018 the mass movement of civil... Read More

“Compared to China’s pro-Palestine stance, Taiwan differentiated itself with open support for Israel since the beginning of the Gaza War. Constant engagement and diplomatic... Read More

Distopia americana analizza l’involuzione del sistema politico statunitense, approfondendone le cause: dalla crescente dipendenza della politica dal finanziamento privato di un’élite di supermiliardari e grandi... Read More

“Nel conflitto russo-ucraino si è visto che la Russia usa un sistema logistico ancora molto labour-intensive. L’Ucraina è in qualche modo riuscita ad adeguarsi... Read More

Copyright © 2025. Torino World Affairs Institute All rights reserved